How To Use Them To Target Profitable Keywords

If you’ve sold your own brand(s) of products on Amazon for any amount of time, you’ve likely realized data is important.

Things like ‘search volume’ or ‘impressions’ etc for example.

You’ve likely used metrics like these to optimize your listing(s) or ads. Essentially data helps you correct course while you’re flying the e-commerce airplane.

Get Our Internal Amazon Listing Optimization Operating System and increase conversions by 18%+ HERE 👇

What Data Is Important To Your Business?

So what data points do brand owners need anyway?

While each seller has their own metrics they deem important, there are some universally helpful data points that anyone marketing a product online should leverage:

- Keyword search volume

- Unit session percentage (conversion rate)

- Number of competitors

- Number of impressions

- Percent impression share

- Click through rate

There are likely many more but within the confines of what information Amazon makes available to brand owners, this list is a great example of data that a seller can leverage for greater marketing.

Why Is This Data Important?

This data is necessary at many points in a seller’s journey…

Search volume helps illuminate how much traffic a term may get. By showing how many times a keyword is searched you can determine how often shoppers are looking at the search results looking for a product to meet their needs.

Unit session percentage, otherwise known as conversion rate, helps you to know how well the information on your listing is converting from page view to a sale. This is likely the most vital piece of information when attempting to optimize.

Knowing how many competitors you might face lets you know how challenging it may be to dominate a niche or market.

Knowing how many people your listing(s) are being shown to helps to determine if you are bidding the right amount in PPC. In an organic setting it also lets you know how many people see your listing where you currently land in rank for a search term.

Percent impression share lets you know the number of shoppers searching for a term that top ASINs share as well as how much of the total your product receives. This is important to know for two reasons. Knowing where your listing stands lets you know how much work you need to do, and knowing how top ASINs fare gives you an idea of what to expect if you make it there.

Click through rate is how many people saw your listing on a page (search result page or otherwise) and decided to click through to take a look. This is important to know because it informs you whether your main image or title needs improvement, or whether the keyword you are targeting is relevant or not.

So as you can see, whether you are launching, optimizing, or funneling more funds into advertising, these metrics are critical.

Amazon’s Brand Analytics More Powerful Than Ever

It’s no secret that one of Amazon’s biggest revenue generators is third-party sellers. As such, over the years Amazon has dedicated more and more tools to help sellers scale their brands on the platform while also becoming as dependent as possible on its assistance.

Originally FBA was designed as a way to let people resell big-brand goods on the “everything store.” However, after private-label branding caught on, Amazon quickly realized that brands were using their platform as a springboard to scaling.

From this understanding and a willingness to cater to that segment of seller, Amazon began to evolve its Brand Registry program. First, it was simply a way to assign greater listing contribution access to a seller. Then it became an avenue for sellers to combat fraud.

From there Brand Registry became required in order to access new data analytics. Amazon gave us keyword search frequency rank, and the ability to see the top ASINs getting clicks and purchases from a keyword. Amazon also let us monitor repeat customer behavior or multi-item cart data.

After years of API leaks, algorithmic estimations and outright data breaches, Amazon decided to expand the data even further and offer keyword level metrics that revealed such coveted details as real search volume (a number previously cobbled together from real and estimated information).

Now we have the Search Query Performance dashboard as the default for Brand Analytics. What’s more, aside from the keyword drill-down the dashboard gives at a brand level, recently Amazon introduced ASIN level keyword data as well.

Now, all of the above necessary metrics for a brand to market and scale are available, and then some. Let’s take a look at how to use these new data features.

Real-World Example Of Data In Play

One of the most important and challenging parts of building out a brand on Amazon is choosing the right keywords. Keywords are everything on the marketplace after all. In fact, some have gone so far as to say that you aren’t even selling a product if you’re selling on Amazon…you’re selling keywords.

That said, both initial keyword research for the purpose of listing creation as well as keyword research to determine the most important terms to target in promotions and PPC are vital to the success of an Amazon business.

No one understand this better than Amazon, which is why the new Brand Analytics Search Query Performance Dashboard is where you immediately land when you click under the Brand tab in seller central.

You will then see keyword data through every phase of the customer journey at a brand level, but as mentioned above, you have the option to dive into these metrics at an ASIN level now too.

ASIN-level keyword data is probably the most useful and actionable data you can get from Amazon. Let’s drill down what all the metrics mean.

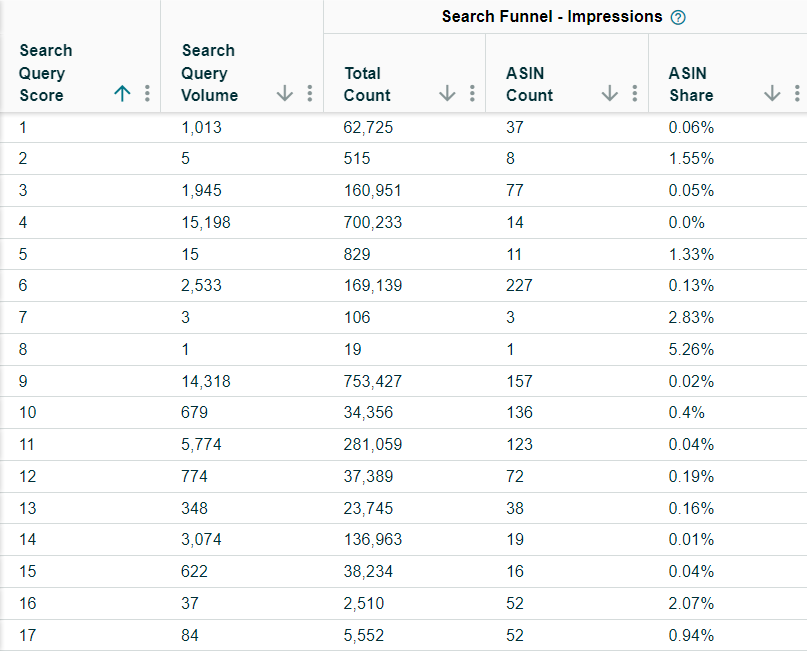

The very first metrics deal with the keyword itself, where you get the actual search volume for the period of time chosen as well as a search query score. Now, what is a search query score, especially as it pertains to an ASIN?

Amazon claims it is based on performance, so that leads us to believe this is the performance of the ASIN with regard to that keyword. Now, we also understand that performance does not only mean sales to Amazon, but most likely relevance, since relevance is connected to a large number of performance-related metrics (like click through, add to cart, etc).

As such, we believe that the search query score is, in a roundabout way, scoring the relevance of the keyword for the ASIN being analyzed.

After the keyword information the first portion of the customer journey funnel deals with impressions. You’re shown total impressions, number of total ASINs being shown for that keyword, and your ASIN’s share of the total impressions.

What can you do with this information?

Right off the bat you can see highly relevant keywords and how many searches they get. If your aim is to get to profitability as quickly as possible, you may choose to identify the highest searched and highest scored keywords.

From there you can see how much competition and what your share of impressions is among those competitors. Based on this you can know how much more effort you may need to put into getting greater visibility for the keywords you’ve identified as important.

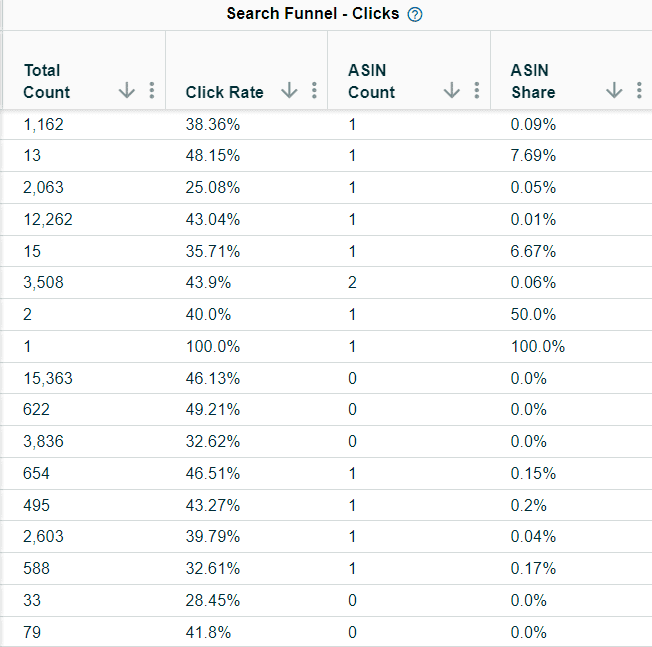

The next section of the customer journey funnel deals with clicks. Here you can see the total clicks for the keyword, the click rate which is the ratio of total clicks to total impressions, and your ASIN’s share of those clicks.

How is this helpful?

Knowing how many clicks you are getting compared to your competition really lets you know how good your main image and title before truncating are at getting attention. This is incredible data for optimization purposes.

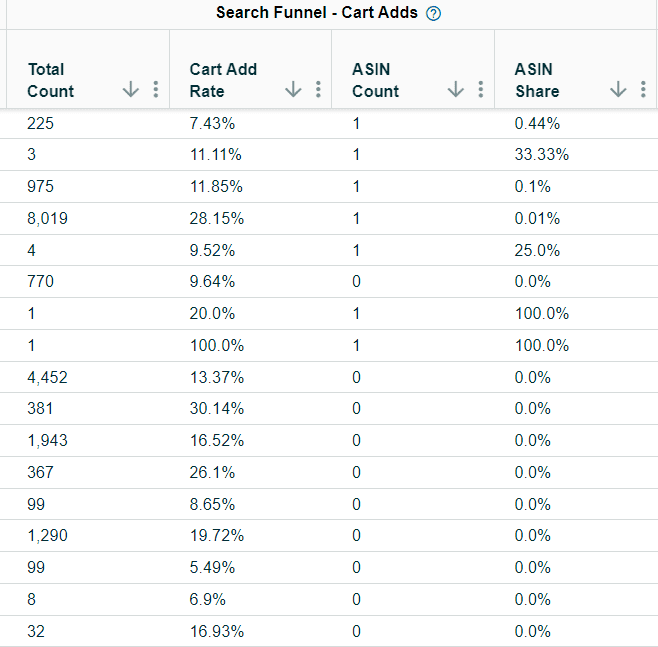

The next section deals with add-to-carts. Here you see the total add-to-carts that resulted from the keyword search, the total percentage A2C rate, and your ASIN’s share of those cart adds.

How can you use this?

Seeing how well your listing convinces shoppers to add to their cart is a fantastic way to optimize for conversions. This is where all of the in-listing details, such as imagery, bullets, and A+ content play their role.

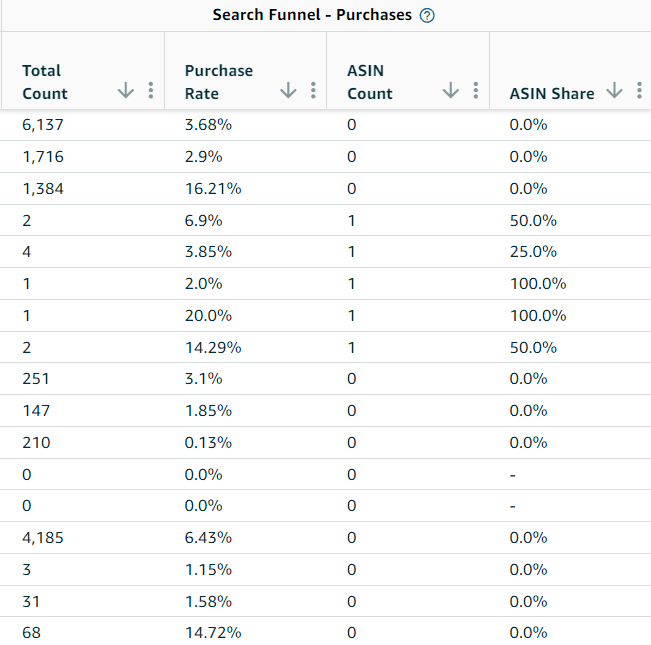

Finally, the last part of the funnel and therefore the last bit of data shown is purchase information. Here you see the total purchases, the total purchase rate from the search query, and your ASIN’s share of those purchases.

This is a great way to identify longer tail keywords with high purchase intent that lead to sales. It’s also a great way to measure profitability against competitors by seeing overall purchase share.

Combine This Data With Opportunity Explorer

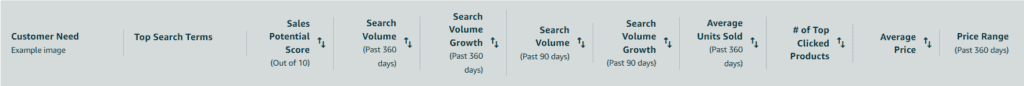

Most of us have had access to the Opportunity Explorer for awhile now, but these new ASIN-level keyword features combined with the explorer really create a synergistic advantage.

By entering in a “niche” you can find the keywords Amazon has identified as an opportunity. When you look up the keywords you’ve identified from your previous research you’ll be able to determine what Amazon believes their sales potential is.

Obviously these tools only work for brand registered brands with products that already get traffic and have sales history. However, for optimization and expansion within the niche, the Search Query Performance Dashboard and Opportunity Explorer provide the much needed second half of the puzzle.