Amazon encourages compliance in their TOS to ensure a smooth and rewarding selling journey in the platform. In the same way, it will also benefit the whole customer experience by fueling the algorithm to improve the results’ relevance to every search query.

The challenge here though is that Amazon does not give full disclosure of how their algorithm truly works – including the changes. The digital space is ever evolving by how users use it, thus the constant updates. Marketers and sellers are left with discovering them and optimizing their product listing following these.

For a long time unit-session percentage, or as we refer to it, “conversion rate” was the most powerful factor for keyword rank on Amazon.

And it makes sense. Amazon is a shopping platform. Amazon’s search function allows shoppers to find items they are looking for. With such a huge catalog, Amazon has to order those items somehow, so the most logical way is by relevance.

Well, what better way to determine whether a product is relevant to a search than by popularity?

If other people searching for the same thing have bought something, then this must be a popular choice for that keyword. Thus, this is the thing the platform should display first. And so on.

That meant that, for the most part, the item with the most sales in relation to searches for a keyword, would get the highest rank.

So the name of the game for third party sellers on Amazon was to get the highest conversion rates possible, rank above the fold, and rake in the sales.

Enterprising marketers just had to figure out how to attribute a sale to a specific keyword, then drive a ton of volume to that keyword. That’s something not in the books.

In the early days of third-party seller launch strategies on Amazon, this was done through something called a “Super URL.”

At first, people would simply run a search on Amazon, click through the pages until they found their product, then click on their product and use the resulting URL. This seemed to work in the beginning (first tested by book publishers before private label got popular).

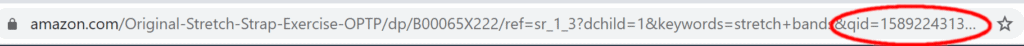

However, it wasn’t long before the strategy stopped having as good of an effect. Many speculated that it might have something to do with the “QID” or timestamp found in the URL.

See, when you click on a product listing on Amazon’s catalog, the URL is time-stamped with a Unix code called a QID.

That meant that Amazon could easily see that it was a single session that generated the URL and any traffic to it should not be considered unique visits.

This is when the Super URL was born. It was a URL generator that injected a QID into the URL every time someone clicked on it. This meant that you could generate a keyword embedded URL on Amazon and have visitors to the URL get a fresh time-stamp.

Directing promotions to a Super URL seemed to be the magic bullet for awhile. Unfortunately, much like the non-sophisticated normal keyword URL, the Super URL seemed to lose effectiveness over time (with regard to ease of ranking during a promotion).

At the time it wasn’t entirely clear if this was a covert (because it wasn’t related to any known TOS update) concerted effort by Amazon to diminish the effectiveness of Super URLs or if it was just because EVERYONE was using them (and therefore the effects were just diluted).

Suffice it to say, there was a time when you could run a mere handful of promotional sales through a Super URL and quickly rank within the top five spots for a competitive keyword. After about ten to twelve months, it was apparent this was no longer the case.

So there, Amazon is not running businesses by the books, rules, or policies. Though the clear purposes are of course revenue generation, brand awareness, and business growth, the way there is not the same all the time for everyone.

Hacking the Wishlist

As with websites, Amazon uses sophisticated tools to gather data and process them into something that can improve the whole customer journey. Hence, you get updates on new features or improved processing capabilities of software plug-ins.

The trend with Amazon updates involves dynamic content, ad targeting, ranking influencers, and fees. All of which aim to make the platform more competitive and fine-tuned to ever-evolving customer needs.

As Amazon became more efficient and evolved its algorithm, sales alone stopped being the only seeming factor for keyword rank. Amazon was actively testing several different site features in an effort to drive as much traffic back to the platform as possible.

One way they did this is with a feature called the Amazon Wishlist. A wishlist is a great way to store items that you want but aren’t planning to buy right away.

This list is also publishable, meaning it can be made public so that others who want to purchase gifts for you can easily choose an item you want from your wishlist.

Aside from a convenient and novel feature for users, this benefits Amazon tremendously for obvious reasons. It causes shoppers to come back onto the platform and make purchases saved for later, or encourages others to make those purchases for them.

Seeing as Amazon wanted to encourage the use of this feature, and they could likely correlate positive sales volume with the use of their Wishlists, they allowed wishlisted items to experience the benefit of keyword rank increase.

According to Amazon’s apparent logic, items that were wishlisted by several people indicated strong buying intent, and therefore this translated to relevance. And, as discussed earlier, relevance is the most efficient way to sort items.

For this reason, products could be added to multiple wishlists and see a rank improvement for important keywords. This was an exciting byproduct that many sellers took advantage of. That is, until bots were created to automate this process.

When this aspect of the algorithm was heavily abused, Amazon had to make changes again. It appeared that not only did they take away the power that wishlisting products lended to keyword rank, they also made the process of creating a buyer account much more complex.

As you know, black hat strategies include creating dummy accounts and using bots to mimic typical buyer activities that influence ranking like wishlisting. And Amazon already made it clear that it won’t tolerate such anymore.

By making any wishlisting benefit only available when utilized by real accounts, this further eliminated the actions of bots and bad actors.

Conversion Rate Is Dethroned

As discussed earlier, conversion rate USED to be the king metric for ranking, and logically so. It wasn’t until the first reports we began to get from large sellers (doing over $100k per month in revenue) that unit session percentage didn’t appear to have as much of a correlation that we started to really look into the matter.

We started getting anecdotes from people that they didn’t believe conversion rates had a negative impact on their ranking, as evidenced by their sessions going through the roof, and unit session percentage dropping to 2-3% but rank remaining stable.

This was odd in and of itself, however then we (at the time myself and my colleagues at the launch service I worked for) started seeing that our results were no longer outpacing our competitor’s.

See, at that time we had a major competitor who offered a similar launch product. Our single advantage over them, and the thing that kept our results far superior to theirs, was the fact that we had a system in place that stopped buyers from continuing to the listing page after all coupon codes were used up.

That meant only the buyers who were intending to purchase visited the page (created a session) and when they purchased that became a conversion (unit session percentage went up). So, our clients were seeing conversion rates at 60-70% or higher and ranking accordingly.

Our competitor, on the other hand, allowed buyers to visit the product listing irrespective of their claiming a code and intention to purchase. With many buyers actually doing their product research on Amazon before deciding whether to take advantage of the deal, or looking at the offer even after codes were all used up, their clients didn’t get the benefit of such high conversion rates.

Then suddenly that just didn’t seem to matter anymore. Their clients began raving about their results, posting screenshots of their success in unprecedented numbers.

All this was quite enough for us to realize something had changed.

Relevance Became the New King

Apparently, most of us just know that Amazon SEO also works around the aspect of relevance. And the good old “The higher the sales, the higher the ranking”. However, things get more complicated since, on the buyer’s end, the items that show on the higher ranks are also the ones more likely to generate more sales. And yes you are correct in noticing the event – it’s a cycle – each action feeds the other.

This feedback cycle is intimidating to most if you don’t have a deep level of understanding of the Amazon algorithm. That is, how certain factors affect relevance and ranking. New entrants seem to be on the disadvantaged side.

Now, recent changes were found that the algorithm leans more on buyer activities and then links them to keywords ranks and conversions. This impresses that a lot of ranking juice comes from buyer-initiated activities like reviews, organic sales (sales coming from search queries made on the search bar), Wish lists (made by real accounts), etc.

There had been also rumors from the forums about relevance. Some who followed Amazon’s movements closely with a strong history in Google noticed the changes first; slight differences in the way listings indexed their keywords.

Now, keyword indexing is a fundamental algorithm activity and any changes in how it was being carried out can significantly affect the way we do Amazon SEO and PPC. It’s any marketer’s nightmare.

Around the same time Amazon was changing back-end search terms…again and again….and again. It was getting confusing what their end goal could possibly be.

But the biggest insights came from an exchange I personally had with seller support. At the time, I was selling a kitchen gadget. This gadget was a multi-functional tool that did several things, but two of its main features were a can opener AND a bottle opener.

I was getting frustrated because no matter where I put the word “bottle opener” in my listing; title, description, search terms, subject matter, etc, it still would not rank for that keyword.

As a last resort, after exhausting all of the strategies I was aware of, I contacted Amazon. I learned from them that this product’s item-type keyword was “can opener” and therefore it could not rank for the term “bottle opener.” This came as a shock.

The reason is because my listing indexed for bottle opener. If it indexed, and it was relevant, why wouldn’t it rank?

That’s when I learned that item-type keyword determined where the listing was placed in subcategories, as well as how many and which additional subcategories the listing could rank within.

I also learned that the categories determined what keywords the listing was relevant for or even which keywords it was eligible to rank for at all…

WOW.

This was relevance at play.

Amazon was determining relevance based on categorization (initially). And relevance dictated what keywords a listing could rank for, regardless of whether spiders indexed it or not.

This explained so much.

- This explained why you could index for a keyword and run PPC, promos and everything in between targeting that keyword and not rank for it.

- This explained why you could be ranking for keywords that were not in your listing at all or that you weren’t even indexed for.

- This explained why a change in category would wipe out rankings altogether.

This also had an impact on ranking overall. Suddenly listing traffic and activity impacted rank (in a positive way) again. Wishlisting campaigns seemed to work again as long as the wishlists were real from real accounts.

External traffic also started making keyword rank fluctuate, regardless of whether it led to an immediate sale. Social sharing, review upvotes, and all other manner of on-page activity seemed to have a positive effect on keyword rank (for a time).

Since then, Amazon has made “fake” activity less impactful (for example, external traffic only helps so much but conversions need to occur now). However, on the whole, many more levers exist that can impact relevance and pulling them will help with keyword rank.

Ranking Patterns From the Eyes of a Launch Service

Over time with all of these shifts in the algorithm, launch services have seen first hand, at scale, how ranking has been impacted. Here’s a glimpse of what it looked like during the hay day of deep discount promotions:

- One day discount promotions of 100+ units stopped consistently ranking products.

- Multi-day discount promotions (first four, then seven days in a row) stopped consistently ranking products.

- Staggered discount promotions (every other day) stopped consistently ranking products.

- Discount promotions altogether stopped consistently ranking products.

Since those days, I’ve also even seen the diminished effects of two-step URLs, Search-Find-Buy, and even rebates. All the while, outliers have reported results from the old, no-longer-working tactics such as traditional SuperURLs and deep discount coupons.

How is that?

Is it cyclical?

Is Amazon removing constraints they’d previously put on promotion strategies?

What causes these anomalies? Why are some things consistent and others not?

It seems apparent now that the strategies that work best are those that don’t focus entirely on a single channel or tactic. Campaigns with mixed strategies have proven be the most effective.

That is why some people use the newest methods and don’t see consistent results, while others use outdated tactics and get the results they hoped for. When your over-use of a promotion channel is obvious, Amazon’s algorithm is aware and likely takes action accordingly.

On the other hand, if your marketing is mixed, it looks much more like you are attempting to promote your product to a wider audience to grow an organic following, rather than exploit a weakness.

And the reason Amazon cares about this is because it all impacts the user experience, which is the number one asset Amazon has.

So, where does this lead to? One thing’s for sure is that the term “relevance” in Amazon will always be a subjective term; it can be relevance to a direct search query or an actual buyer intent. And it is the seller’s or marketer’s responsibility to seek that information and adjust his strategies accordingly.

Another thing is algorithm intelligence. Amazon is crazy about understanding human behavior when it comes to purchasing. Thus, it intends its AI to be so powerful not just in gathering data but in turning them into insights that can encourage traffic and sales.

And with that, Amazon needs to continuously test performance and update applications. And everyone has to evolve at who-knows-pace.

Good problem? Every business should say Yes to that. One of the best things about the platform is it also works as a community. Amazon do not tolerate unfair practices. It puts premium in its customers’ satisfaction. The algorithm is ever-evolving.