What you didn’t know about Amazon’s “second-price” auction

You could be leaking funds into Amazon’s advertising platform and not even know it. And we’re not even talking about money left on the table from unoptimized ads. We’re talking about Amazon not being fully transparent about how their ad platform spends funds, and that leading to sellers being totally unaware of being overcharged, sometimes significantly.

We’ll get into exactly how this is happening and the research and experiments that led us to this conclusion. First, however, let’s start with a primer on ad platforms in general…

Get Our Internal Amazon Listing Optimization Operating System HERE 👇

What Is an Advertising Platform…Exactly?

This may seem like a silly question, but bear with us. We just want to make sure everyone is on the same page. Most of us, as Amazon sellers, have an idea of what an advertising platform is, even if we’ve never used any other besides Amazon.

An advertising platform is simply a platform that facilitates pay-per-click promotions (in the case of CPC, not CPM…but that’s for a different conversation). These promotions, or “advertisements” come in the form of text, imagery, video, or a combination of media types and are designed to persuade potential customers to look further into a company’s offerings.

The platform then charges advertisers to place those advertisements in view of those potential customers. Easy-peasy, right?

What Are Auction Types?

Ok, here’s where we get into the meat and potatoes of the issue. Auction types are not as well-known a topic. So what are they?

Auction types are the way in which an ad platform charges their advertisers. One favors the advertiser while still giving benefit to the ad platform, and one favors the ad platform while still giving benefit to the advertiser.

First-price auction vs Second-price auction:

First-price favors the “publisher” or ad platform. This is where the highest bidder for clicks wins, and their bid price is the clearing price. It’s a great way to maximize profits for the platform, however, it has some major drawbacks for advertisers.

For one thing, overpaying is rampant. Advertisers don’t know what their competitors were willing to bid, so many end up paying much more than they would have. For this reason, first-price auctions often get lower adoption.

EXAMPLE:

Advertiser A bids $1.00

Advertiser B bids $0.73

Advertiser C bids $1.23

Advertiser C wins the bid AND pays $1.23 per click

Second-price auctions work much more in favor of advertisers. With second-price auctions, the winner of the auction only pays one cent more than the second highest bidder. So, regardless of what amount an advertiser bids, if they win, the clearing price will be one cent more than the second highest bidder’s amount.

This prices “ad inventory” much closer to what it’s actually worth. For this reason most programmatic ad platforms use second-price auctions.

Example

Advertiser A bids $1.00

Advertiser B bids $0.73

Advertiser C bids $1.23

Advertiser C wins the bid but pays $1.01 per click

Which Platforms Use Which Auction Types?

Walmart.com’s ad platform offers first-price auction bidding, while most other large players like Facebook, Snapchat, and yes, Amazon, use second-price auctions.

Google was also a second-price auction for a long time, but recently switched Adsense and Ads Manager to first-price, while other ad platform properties still remain second-price.

All in all it appears to be a mixed bag, but the important thing to remember is that Amazon PPC is a second-price auction.

Amazon Advertising Claims

Interestingly, Amazon using the second-price auction appears to be an assumption. It’s assumed based on the fact that we know they don’t use first-auction. However, they don’t appear to explicitly say the price of a click will be one cent more than the second highest bidder.

If you fall down the rabbit hole of Googling, you’ll see tons of articles talking about Amazon Sponsored Products’ second-price auction system, yet nothing directly from Amazon owned sites.

The Amazon advertising site only has this to say:

“CPC is determined by its ad ranking as well as the ranking of other related brands and products”

They also say this:

Plenty of mention of the fact that you are bidding against other advertisers, and even mention of ad rank, but nothing that states your cost will only be one cent higher than the last bidder’s. Be that as it may, second-price auction is what has been expected from the platform, since it has become an industry standard.

Experiments Debunk Amazon

Whether or not Amazon explicitly claims they offer a second-price auction, or is purposefully allowing everyone to simply believe that is the case, we’re here to uncover the truth. Below are the results of experiments and tests run by Signalytics (Marketing Director Baldwin Thai) at the direction of theories by Tarik Berrada Hmima of M19.

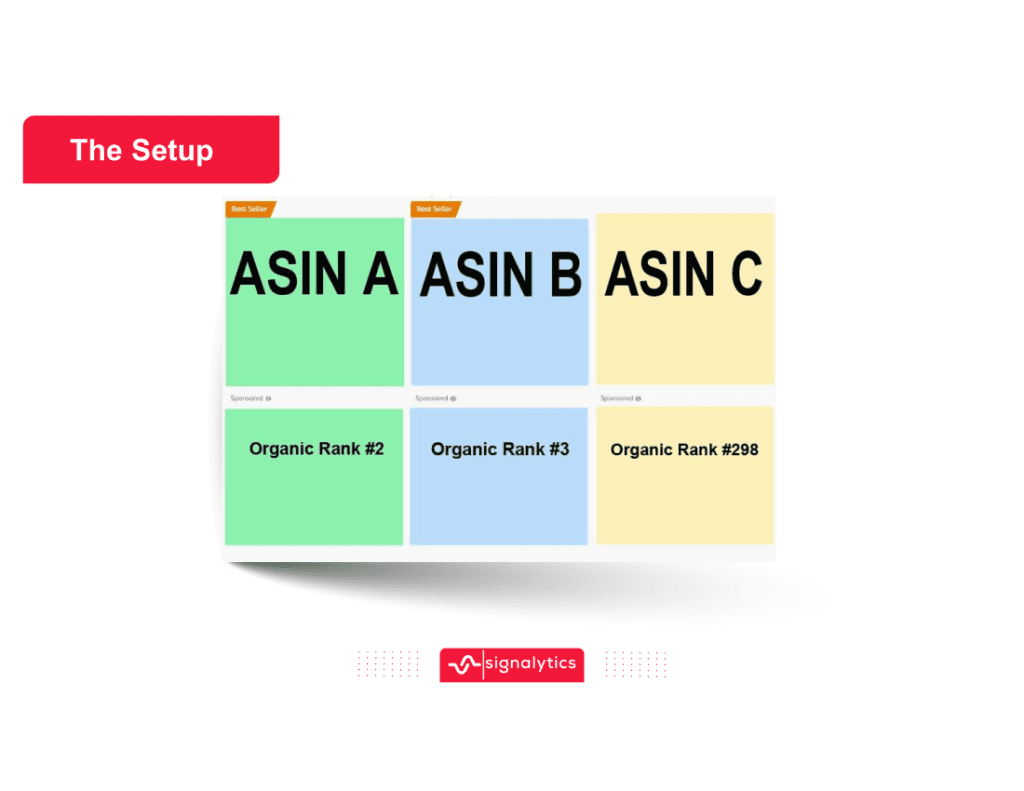

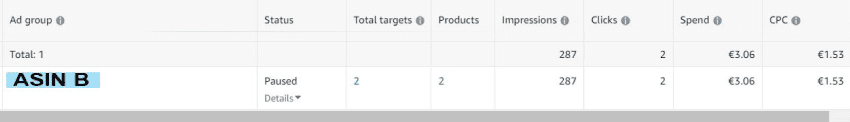

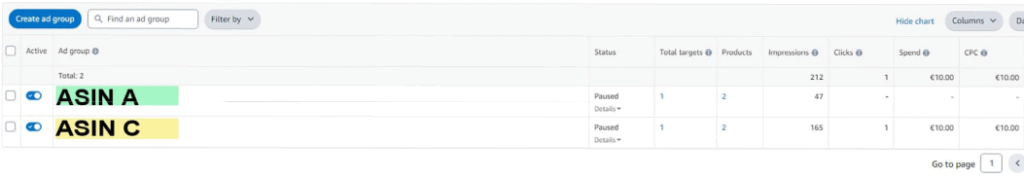

First, we used Sponsored Product Ads with fixed bidding. We controlled the ads for three ASINs. Two ASINs were organically ranked in positions two and three for the keyword we were targeting. The third ASIN was ranked position 258.

The goal was to bid up until the ASINs were shown in the top spots for the target keyword, and then record how much of that bid would be charged for a click. Here are the bid results that got the ads into the top three spots on page one:

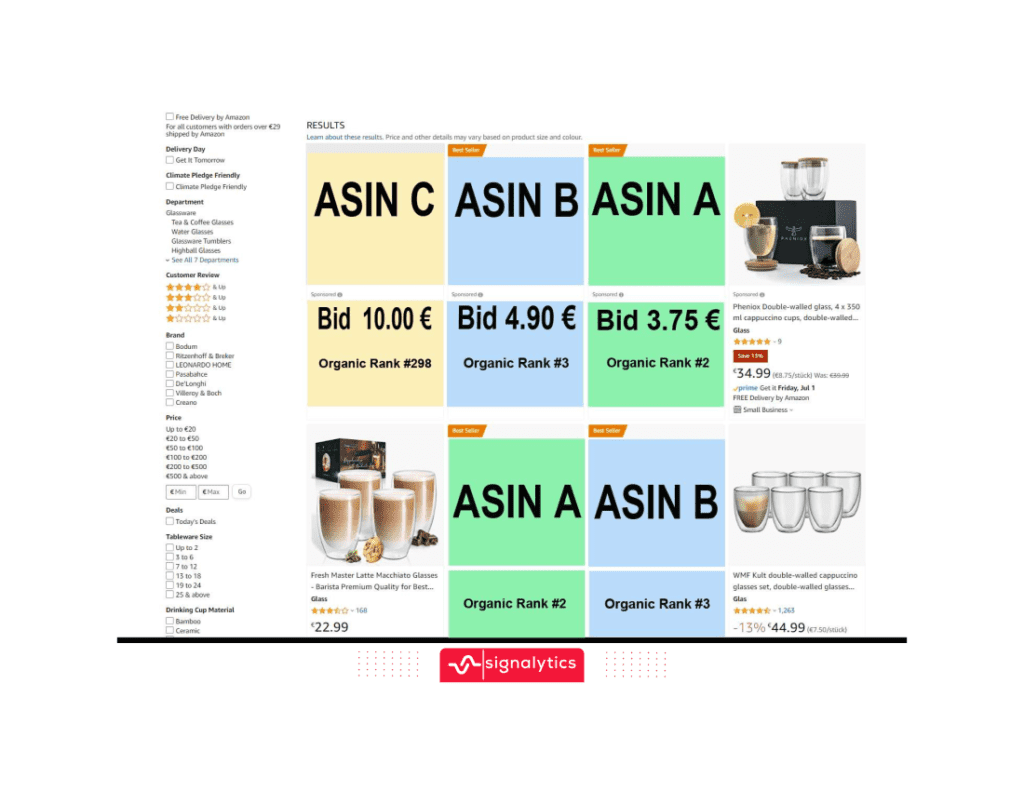

Now, theoretically, according to the second-price auction model, a click on ASIN B should cost $3.76 and a click on ASIN C should cost $4.91. Here’s what happened when we clicked the ads, however:

ASIN B’s ad was only charged $1.53 per click! How is that even possible? That’s lower than the last bid amount by more than half. That’s terrific though, right? Well, in the case of ASIN B, sure. However, ASIN C was not such a pretty picture.

As you can see, ASIN C’s ad cost $10 per click. That was the entire bid amount, and this is exactly what you would’ve paid in an archaic and inefficient first-price auction on a platform like Walmart.com.

How did this happen?

Theories and Conclusions From the Data

Ok, so we know Amazon has limited ad space to offer (though they increase that ad space seemingly every year). For this reason, they have an internal arbitrage system where they rank who gets that limited ad space.

In a pure advertising platform, that space may be won out by the highest bidder. However, Amazon is not solely an ad platform. It is an online marketplace that prides itself on putting the desires of customers first and foremost.

This is how we can totally understand why Amazon states that cost-per-click is determined by bid, competing bids, AND “ad rank.” And because of what we understand about Amazon’s ranking algorithm, we can conclude that ad rank is determined, at least in part, by relevance.

This makes perfect sense, too. We already know Amazon has a relevance engine. We understand (to a degree) how it works. Inventing new technology just for the ad platform would be expensive and time consuming. It is much easier to connect relevance to ads.

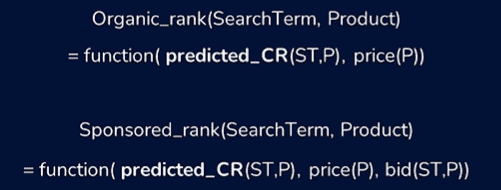

Relevance as a factor in CPC is also an idea supported by the experiments and research of our friend Tarik who shared this formula with us:

The formula shows that the only difference in determining sponsored rank over organic rank is the bid element.

How Machine Learning Works On Ad Platforms

The reason these conclusions can be made is based on how machine learning works on ad platforms in general. Ad platforms look to maximize conversions. This goal aligns perfectly with the goals of Amazon as a whole as well.

Maximizing conversion rates solves all issues and leads to all desired outcomes for Amazon. So, if we take this to be the most likely scenario, then conversion rate would be the “multiplier” for rank sort weight.

Now here’s where understanding machine learning comes in. The way ML makes predictions is with complex formulas using historical data, and part of that equation is estimated (or expected) conversion rate. In the ML’s estimated conversion rate it uses a number of factors, or “features” discussed in our previous article on how the A9 works.

Conversion rate estimation would work the same in Sponsored Ads, except for the additional factor of bid. This can be (and has been) tested by recording changes in PPC rank based on changes in bid amount.

The result of those tests showed that you can absolutely increase PPC rank by increasing your bid.

How This Fits With What We Know About A9

This means that ads are impacted by keyword relevance, just like organic rank, on the Amazon marketplace. Everything that we’ve learned about keyword relevance and how it affects our organic rank is at play and also impacts PPC rank.

If the experiments and research are being interpreted correctly, and the theory that the machine learning relevance formula is the same for both organic rank and sponsored product rank, with the only difference being bid amount, then your ad costs, and thus your business costs, will rest heavily on your keyword relevance and all the factors that are connected to that (such as category/subcategory, optimization, promotion strategy, etc).

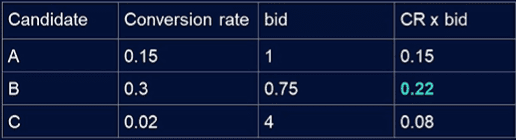

Here is a cost breakdown:

Remember in ML this is an estimated conversion rate based on relevance. So, the higher the estimated (or expected) CVR the lower the bid amount needs to be to win the impression/click.

Connecting the Advertising and Ranking Dots

Holy cow 🤯🤯🤯

In the early days of Amazon seller sophistication we were convinced that everything organic was separate from PPC (and perhaps at one point that was true). If you were unable to put certain keywords in your search terms, you could just run ads for them and force relevance. You could even remain poorly ranked organically but ads would make up 60%+ of your sales so it was ok.

It would seem things aren’t so cut and dry anymore, as the marketplace as integrated its technology. The good news is, this means the efforts most sellers take to increase rank and optimize their offerings on the Amazon platform will impact both organic and advertising standing.

It’s all connected. The category you choose determines the keywords you can be relevant for. The keywords in your listing, combined with consumer activity (and a host of internal metrics) determines your relevance score. Your relevance score determines the machine learning algorithm’s estimated conversion rate. The estimated CVR determines organic AND sponsored rank.

How Sellers Can Use This Information

Ok, that was a lot of brain-mixing data and theory, but what can sellers do with this information?

Here are some suggestions:

- Optimize your listing from the ground up. Optimization is a key to establishing relevance for keywords on Amazon. The keywords in the listing as well as the conversions that come from things like images and video are all crucial here. (Signalytics can help with this, click HERE for more details).

- Do awesome keyword research. Keywords aren’t just important in the listing optimization phase, but overall your keyword research will determine the entire course of marketing for your products. Keywords are important for SEO, for promotions, and for ad targeting. (Sigalytics can help you find the best keywords with a PFR – purchase frequency report. Click HERE to get one).

- Optimize your PPC campaigns. Running ads, testing, course correcting, changing bids, changing keywords, changing ad placements, changing bid types, then repeating. This is how you get the most from your ads. It’s a lot of work, but well worth the ROI. (If you want to fight fire with fire, you can have an A.I. do these tasks for you with incredible speed and accuracy. Click HERE to find out more about Signalytics A.I. powered PPC).

At the end of the day, the name of the game is providing Amazon with exactly what it expects to serve customers what they desire. This means meaningful categorization and keywords for listings, as well as optimal ad placement for those products.